Source: Microsoft

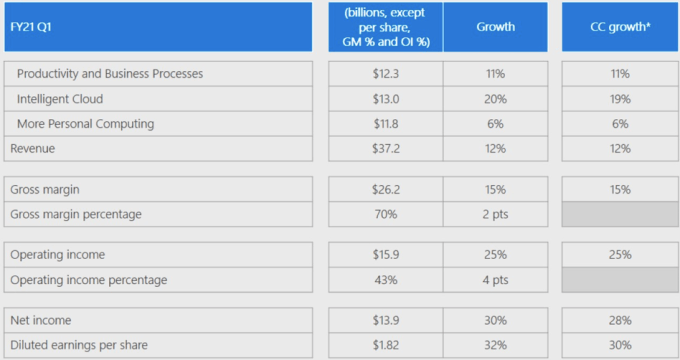

Today after the bell, Microsoft reported its calendar Q3 2020 earnings, the period of that time corresponds to its Q1 fiscal 2021 period. In the three months ending September 30, Microsoft had revenues of $37.2 billion and per-share profit of $1.82.

Analysts had anticipated the company to report $1.54 in earnings per share, generated from $35.72 billion in revenue.

In the aftermath of the beat, shares of the company are effectively flat, gaining only a fraction of a point in after-hours trading. Microsoft was up by nearly 2% in afternoon trading, despite somewhat uneven markets.

Helping drive the movement in Microsoft’s share price was the all-important Azure update. Here’s what Microsoft had to say:

Server products and cloud services revenue increased 22% (up 21% in constant currency) driven by Azure revenue growth of 48% (up 47% in constant currency)

Parsing investor sentiment, it appears that a number closer in the low-40s was anticipated by most, making the Azure result a strong number.

The broader category that Azure sits inside of, called “Intelligent Cloud,” reported $13 billion in revenue, up 20% from the year-ago quarter. That was the best-performing of Microsoft’s three units, which also include the Office-and-LinkedIn heavy “Productivity and Business Processes” group that posted $12.3 billion in revenue — up 11% — and the Windows-and-Xbox heavy “More Personal Computing” which had revenues of $11.8 billion, up a smaller 6% compared to the year-ago quarter.

For the financial dorks in the audience, I snagged the following for your enjoyment:

Other standouts from a first read of the company’s earnings report include:

- Strong Surface revenue, rising 37% compared to the year-ago period

- Bing revenue declines, with the company saying that “[s]earch advertising revenue excluding traffic acquisition costs decreased 10%”

- Commercial cloud revenues of $15.2 billion, up 31% from the year-ago period

- LinkedIn managed 16% revenue gains in the quarter

- Gaming revenue gains of 22% year-over-year

- Consumer PC demand — seen in PC sales numbers — boosted non-Pro Windows OEM revenues by 31% compared to the year-ago quarter, though Pro-focused Windows OEM top line fell 22%. Those partial results netted out to a -5% OEM figure for the company.

Looking ahead, analysts expect Microsoft to record $1.60 in per-share profit in the current quarter, off $40.4 billion in total revenue. The company will announce its own projections on its earnings call.

Update: Got on the phone with Mike Spencer from Microsoft’s IR team to chat about the results. I was curious about the impact of COVID-related advertising declines impacting the company. Spencer said that both Bing and LinkedIn recovered from earlier lows, and both came in above internal expectations. For LinkedIn, of course, that was a better net result than Bing’s, comparing their year-over-year figures, but beating expectations is still good. You can read as much into what the Bing numbers will mean for Google as you will.

Spencer highlighted the Azure number — ahead of internal and external expectations — and the non-Pro Windows OEM number as notable figures from the report. Agreed. The former shows that Microsoft is holding up against Amazon and Google, while the latter shows that when folks buy computers for their home-bound tots, they aren’t only buying Chromebooks.

Microsoft stock flat despite better-than-expected earnings, strong Azure growth