Source: Microsoft

The cloud infrastructure market kept growing at a brisk pace last quarter, as the pandemic continued to push more companies to the cloud with offices shut down in much of the world. This week the big three — Amazon, Microsoft and Google — all reported their numbers and as expected the news was good with Synergy Research reporting revenue growth of 33% year over year, up to almost $33 billion for the quarter.

Still, John Dinsdale, chief analyst at Synergy was a bit taken aback that the market continued to grow as much as it did. “While we were fully expecting continued strong growth in the market, the scale of the growth in Q3 was a little surprising,” he said in a statement.

He added, “Total revenues were up by $2.5 billion from the previous quarter causing the year-on-year growth rate to nudge upwards, which is unusual for such a large market. It is quite clear that COVID-19 has provided an added boost to a market that was already developing rapidly.”

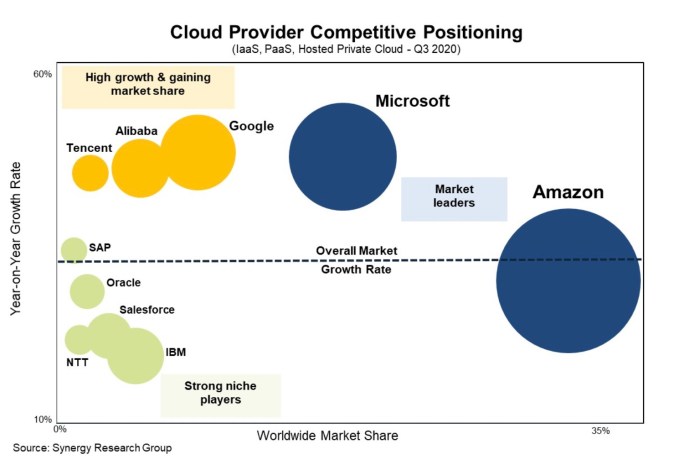

Per usual Amazon led the way with $11.6 billion in revenue, up from $10.8 billion last quarter. That’s up 29% year over year. Amazon continues to exhibit slowing growth in the cloud market, but because of its market share lead of 33%, a rate that has held fairly steady for some time, the growth is less important than the eye-popping revenue it continues to generate, almost double its closest rival Microsoft .

Speaking of Microsoft, Azure revenue was up 48% year over year, also slowing some, but good enough for a strong second place with 18% market share. Using Synergy’s total quarterly number of $33 billion, Microsoft came in at $5.9 billion in revenue for the quarter, up from $5.2 billion last quarter.

Finally Google announced cloud revenue of $3.4 billion, but that number includes all of its cloud revenue including G Suite and other software. Synergy reported that this was good for 9% or $2.98 billion, up from $2.7 billion last quarter, good for third place.

Alibaba and IBM were tied for fourth with 5% or around $1.65 billion each.

Image Credits: Synergy Research

It’s worth noting that Canalys had similar numbers to Synergy with growth of 33% to $36.5 billion. They had the same market order with slightly different numbers with Amazon at 32%, Microsoft at 19% and Google at 7% and Alibaba in 4th place at 6%.

Canalys sees continued growth ahead, especially as hybrid cloud begins to merge with newer technologies like 5G and edge computing. “All three [providers] are collaborating with mobile operators to deploy their cloud stacks at the edge in the operators’ data centers. These are part of holistic initiatives to profit from 5G services among business customers, as well as transform the mobile operators’ IT infrastructure,” Canalysis analyst Blake Murray said in a statement.

While the pure growth continues to move steadily downward over time, this is expected in a market that’s maturing like cloud infrastructure, but as companies continue to shift workloads more rapidly to the cloud during the pandemic, and find new use cases like 5G and edge computing, the market could continue to generate substantial revenue well into the future.

Cloud infrastructure revenue grows 33% this quarter to almost B